Why is the partial autonomy model becoming more and more important?

Full insurers have little freedom when it comes to investing assets, which has consequences—particularly in today's low-interest-rate environment. This explains why partially autonomous pension funds are becoming more popular, which are able to invest independently, covering death and disability risks by means of a life insurance policy. Greater flexibility in making investments allows partially autonomous pension funds to achieve higher returns on average. Example: the Vita Joint Foundation's Vita Classic plan: Between 2013 and 2017 the plan earned an average investment return of 5.38 percent. Large and small companies alike are interested in these impressive results.

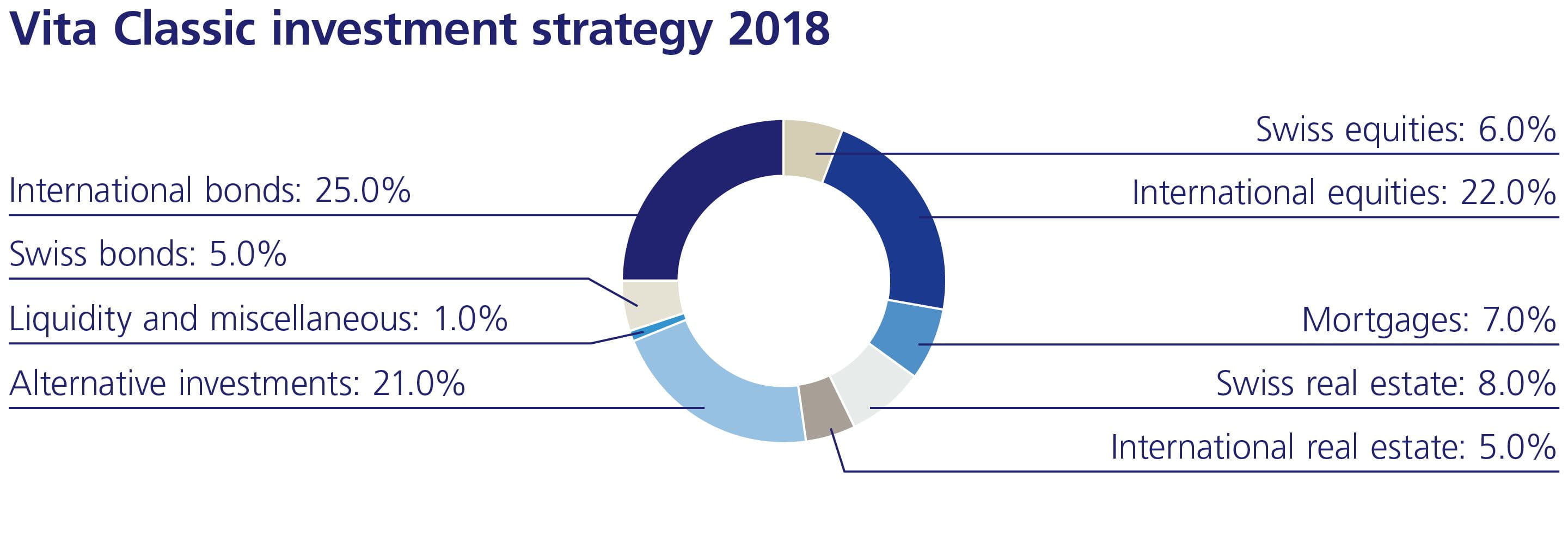

What is the Vita Classic investment strategy in specific?

The investment strategy pursued by the Vita Joint Foundation clearly demonstrates how the statutory investment options can be effectively utilized for the benefit of the insured: The Joint Foundation broadly diversifies its pension funds' assets in order to cushion the impact of short-term volatility in the stock market and other capital markets. A balanced portfolio of equities, bonds and real estate diversifying risk across multiple regions and countries blended with certain alternative investments affords steady, sustainable returns. A long-term investment horizon further enhances stability.

How established is Vita Classic?

The Vita Joint Foundation has now relied on the partially autonomous model – the Vita model – for 15 years. It manages around 13 billion Swiss francs in pension funds’ assets. Vita customers and their employees have benefited from above-average returns over the years on the basis of a broadly diversified investment strategy that yields above-average interest earned. Zurich as insurance partner is responsible for risk coverage, customer service, benefits services and other services. The company’s advisory expertise in pension matters benefits companies small, medium and large across all sectors.

In what ways is your loyalty rewarded?

At the Vita Joint Foundation, corporate customers who have been associated with the foundation for many years enjoy a particularly attractive rate of interest earned. For example, loyal customers are currently earning an overall interest rate of 2.40 percent on their obligatory retirement assets and as much as 3.15 percent on their voluntary (super-mandatory) retirement assets. How these interest rates are achieved: Vita Classic has a guaranteed base interest rate. In addition, returns flow into a separate interest pot when a coverage ratio of 106 percent is reached. These returns benefit the insured, being distributed as additional interest over a five-year period.

Loyalty is thus particularly worthwhile with Vita Classic, and the word has spread among corporate clients, the number of affiliated employers increasing from 18,189 to 21,136 between 2013 and 2017. That represents 16 percent growth, significantly above the average in the stagnating BVG market.